Incorporated as a private limited company in March 1998. Based in London, the company provides a fully tailored chauffeur service to clients with luxury cars and professional services.

The owner and Managing Director, started the business following 20 years of experience, starting as a valeter and moving up the ladder to management. He saw an opening in the market for an executive car service. They have a reputation for high quality, personal approach to clients, transporting them with complimentary WiFi, ensuring a relaxing arrival.

With a head office at Heathrow, and satellite offices at Luton at Gatwick, they now employ 40 staff. They pride themselves on punctuality, customer relations and safety and security. Their client base includes blue chip companies, leading multinationals and celebrities.

The Challenge

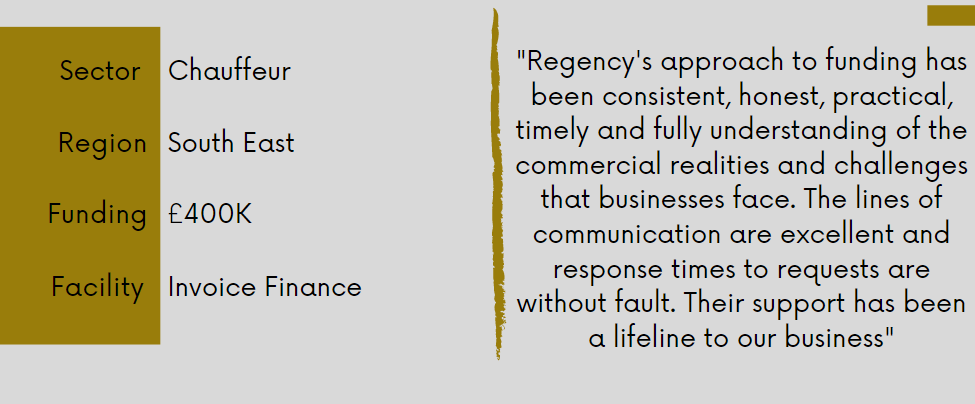

Following the demise of the incumbent lender, our client approached Regency to support the company and their growth ambitions.

The initial invoice finance facility provided by Regency has been the cornerstone supporting the expansion the business has gone through since they joined the Regency family. Things haven’t been plain sailing as they have seen a loss in turnover of 80% since the Covid-19 outbreak.

The Solution

Over the years we have worked closely with our client to gain a deep understanding of the business and build strong working relationships with the team. The invoice finance facility has supported them through the more challenging times, and has been extended to support their expansion into new markets across the globe.

To download the case study click here.

To discuss the funding options available to your business. Please do not hesitate to contact us on 0161 280 4220 or lynnew@regencyfactors.com

what is invoice finance? invoice finance for recruitment, invoice finance for dummies, invoice finance for new business, invoice finance for startups, invoice finance with recourse, invoice finance meaning, invoice finance for small business, factoring example, invoice finance, invoice finance, invoice finance UK, how many businesses use invoice finance, why use invoice finance, why invoice finance, what is invoice finance, invoice finance and factoring, invoice finance and asset based lending, invoice finance agreement, invoice finance advantages, invoice finance arrangement, invoice finance alternative funding, invoice finance for new business, invoice finance blog, invoice finance bad credit, invoice finance benefits, invoice finance case study, invoice debtor finance, export invoice finance, easy invoice finance limited, invoice finance facts, invoice finance flowchart, invoice finance companies manchester