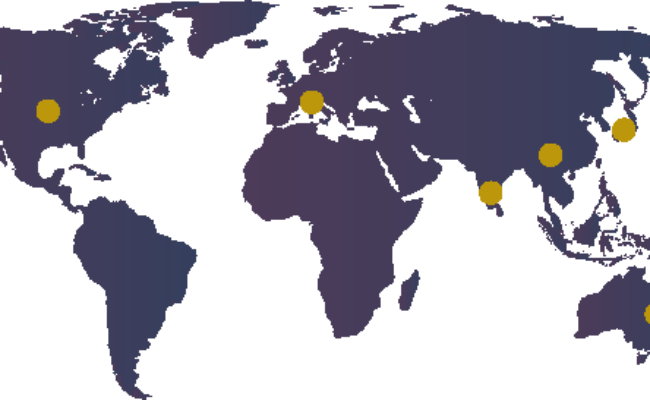

For many businesses, the lure of trading abroad is strong. After all, with so many different markets to trade in and opportunities seemingly endless, it’s…

As we approach the end of June, it’s all about whether the UK will enter a recession. Experts have said that the UK faces a…

A recent study showed that successful business finance applications plunged over the first quarter of this year indicating that banks are pulling the plug on…

The Federation of Small Businesses (FSB) released the Small Business Index (SBI) on Monday 24 Jan for the final quarter of 2021. The index fell…

1 in 3 businesses see late payment as one of their biggest threats to survival

Invoice Finance is an excellent alternative source of finance for businesses by significantly improving their cash flow. With debt factoring, a business can release immediate cash…

With the world caught up in the pandemic and the economic fall out continuing to affect business, poor cash flow can affect much more than…

With the bounce back loans provided to UK businesses rapidly diminishing, it’s time to look at a longer term form of finance for UK SMEs.

Don’t Let Cash Flow Issues Get In the Way of Opportunity Congratulations! You finally landed that big contract you have been pursuing, the one that…

Thinking about your business financing, factoring financing, and po financing are all key parts of planning for a growing business…the product is important but not as important as the finance that will make it a reality