For many businesses, the lure of trading abroad is strong. After all, with so many different markets to trade in and opportunities seemingly endless, it’s no wonder so many businesses are looking abroad to grow their businesses.

Whilst the EU remains one of the most lucrative regions for trading, Brexit headaches have meant that many businesses are looking further afield for opportunities.

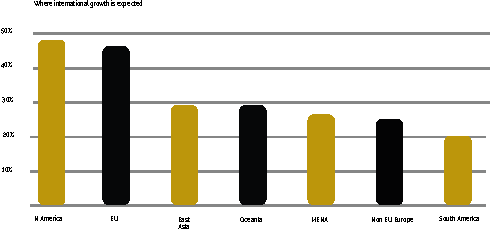

According to research from Santander, 45% of businesses are looking to North America for expansion, and 29% see exciting opportunities in the Eastern Asia region with a number of booming economies and high growth markets opening up.

It takes a significant amount of work to trade cross border; from navigating different regulatory regimes to how to operate logistics across borders.

According to Santander, 63% of businesses have concerns associated with costs associated with trading abroad, such as container costs and ensuring invoices get paid.

A bespoke finance facility with Regency can provide businesses with the cashflow they need to trade abroad and expand.

To discuss the funding options available to your business. Please do not hesitate to contact us on lynnew@regencyfactors.com and we can arrange contact via Facetime, Zoom or WhatsApp to discuss funding “Face to Face”

what is invoice finance? invoice finance for recruitment, invoice finance for dummies, invoice finance for new business, invoice finance for startups, invoice finance with recourse, invoice finance meaning, invoice finance for small business, factoring example, invoice finance, invoice finance, invoice finance UK, how many businesses use invoice finance, why use invoice finance, why invoice finance, what is invoice finance, invoice finance and factoring, invoice finance and asset based lending, invoice finance agreement, invoice finance advantages, invoice finance arrangement, invoice finance alternative funding, invoice finance for new business, invoice finance blog, invoice finance bad credit, invoice finance benefits, invoice finance case study, invoice debtor finance, export invoice finance, easy invoice finance limited, invoice finance facts, invoice finance flowchart, invoice finance companies manchester