When it comes to owning a small business, the first challenge you might face is simply getting your company off the ground. And with nearly half of all small businesses failing within five years, it can be a daunting task. However, once you get past the initial stages and start to taste success, it can be enticing to go for broke and try to expand as rapidly as possible.

Unfortunately, this is not always the best way to grow a business.

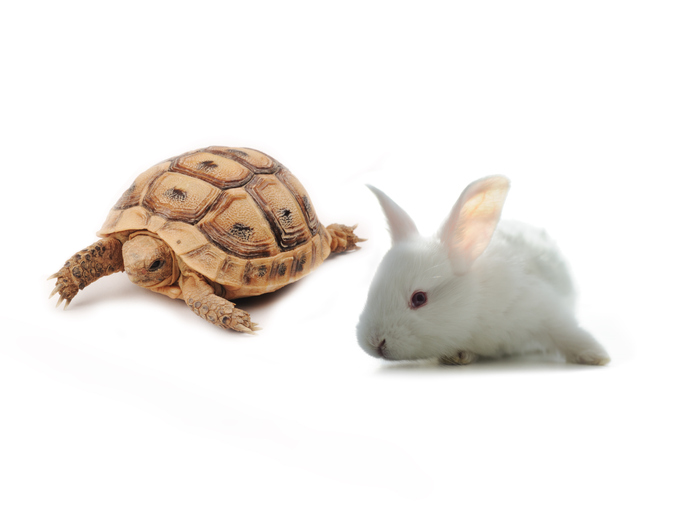

Instead, you should consider taking a slow and steady approach to any growth initiative. Here are four ways rapid business growth can harm a company:

1. Your Customer Service Could Falter. If revenues are excellent and the outlook appears too rosy, you may want to speed up the expansion of your business. However, you must first gauge whether your current staff can keep up with the increased business. Chances are that great customer service helped get your business to its current level of success, so impacting the level of service your customers get might have adverse affects. If your staff members can’t keep up with increased business, where will you be? You might have a business that doesn’t meet your customers’ needs, and some may look to your competition.

2. Your Cash Flow Could Be Affected. A positive cash flow can be a key to the long-term success of any small business. However, expand your business too rapidly, too soon, and you might be in the position of not being able to pay your monthly bills. Even if you don’t face a worst-case scenario of bankruptcy, you may do a great deal of damage to your reputation within your industry. This is where an invoice finance facility can help.

3. You May Lose Sight of Your Original Goals. Experiencing success is exciting, but it should never cause you to alter your original goals. While undergoing any form of expansion, consistently refer to your original goals and make sure any strategies for growth are in line with what you wanted to accomplish at the outset.

4. Employee Turnover Could Increase. Turnover costs can be the death knell of a small business, especially in the beginning. Expand too fast, and you run the risk of frustrating and alienating your staff, which could cause them to resign. Once they leave, you’ll have to endure the significant cost of training new staff members, many of who may not fit the company as well as your previous employees. Keep your staff in the loop regarding all expansion plans, and always keep their interests and feedback in mind.

To discuss the funding options available to your business. Please do not hesitate to contact us on 0161 280 4220 or lynnew@regencyfactors.com

what is invoice finance? invoice finance for recruitment, invoice finance for dummies, invoice finance for new business, invoice finance for startups, invoice finance with recourse, invoice finance meaning, invoice finance for small business, factoring example, invoice finance, invoice finance, invoice finance UK, how many businesses use invoice finance, why use invoice finance, why invoice finance, what is invoice finance, invoice finance and factoring, invoice finance and asset based lending, invoice finance agreement, invoice finance advantages, invoice finance arrangement, invoice finance alternative funding, invoice finance for new business, invoice finance blog, invoice finance bad credit, invoice finance benefits, invoice finance case study, invoice debtor finance, export invoice finance, easy invoice finance limited, invoice finance facts, invoice finance flowchart, invoice finance companies manchester