Communication (read: good communication) is critical for your business to succeed. It helps you establish credibility among clients and even employees.

Yet we tend to overuse the comfortable phrases we’ve become accustomed to. We’re all guilty of using these clichés, so I’ve put together a list with suggestions of alternatives:

I hope you’re doing well – It’s not sincere and has become meaningless due to overuse. Something to catch the readers attention will help in making the email less vague. Hubspot have some good ideas such as

‘I hope you’re having a two-coffee (versus a four-coffee) day’ or

‘How’s life in……. ‘

Per our conversation – This can sound passive aggressive, or like you’re saying you don’t trust the person to remember your discussion. Try “After you mentioned….. , I decided to”

Low-Hanging Fruit – Are you picking apples to make a pie? No, you’re looking at a quick win. A better phrase might be:

‘What are the easiest goals for us to reach right now? Let’s focus on those first.’

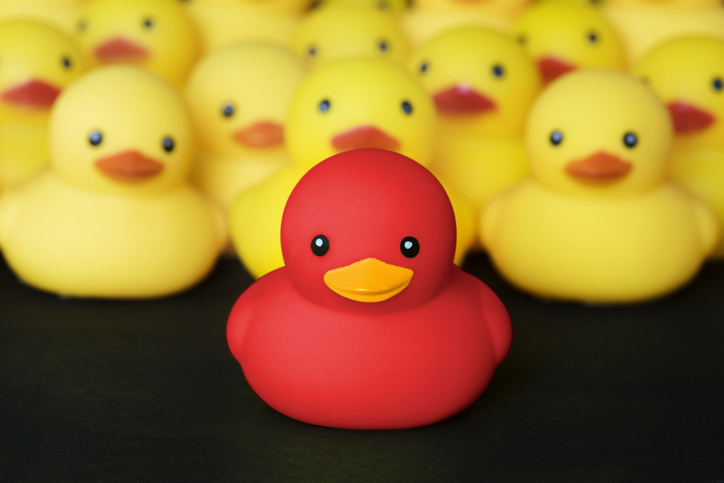

Get all your ducks in a row – be organised. Bert and Ernie from Sesame Street had an obsession with rubber ducks. You may think I’m disorganised, but there’s no need to talk to me like a five-year-old.

Sorry for the late response – Are you really sorry? Try using these instead. ‘I wanted to give your proposal some thought’ or ‘A few things came up, I appreciate your patience’

Thank you in Advance – Your intentions are probably good, but the recipient usually interprets this as “You don’t have a choice; you have to do what I’m asking”. Try an alternative “Thank you for any help you can offer” or “Really appreciate your time here” .

Whilst email cliches exists for a reason, there are alternatives that make you stand out a bit more.

To discuss the funding options available to your business. Please do not hesitate to contact us on 0161 280 4220 or lynnew@regencyfactors.com

what is invoice finance? invoice finance for recruitment, invoice finance for dummies, invoice finance for new business, invoice finance for startups, invoice finance with recourse, invoice finance meaning, invoice finance for small business, factoring example, invoice finance, invoice finance, invoice finance UK, how many businesses use invoice finance, why use invoice finance, why invoice finance, what is invoice finance, invoice finance and factoring, invoice finance and asset based lending, invoice finance agreement, invoice finance advantages, invoice finance arrangement, invoice finance alternative funding, invoice finance for new business, invoice finance blog, invoice finance bad credit, invoice finance benefits, invoice finance case study, invoice debtor finance, export invoice finance, easy invoice finance limited, invoice finance facts, invoice finance flowchart, invoice finance companies manchester