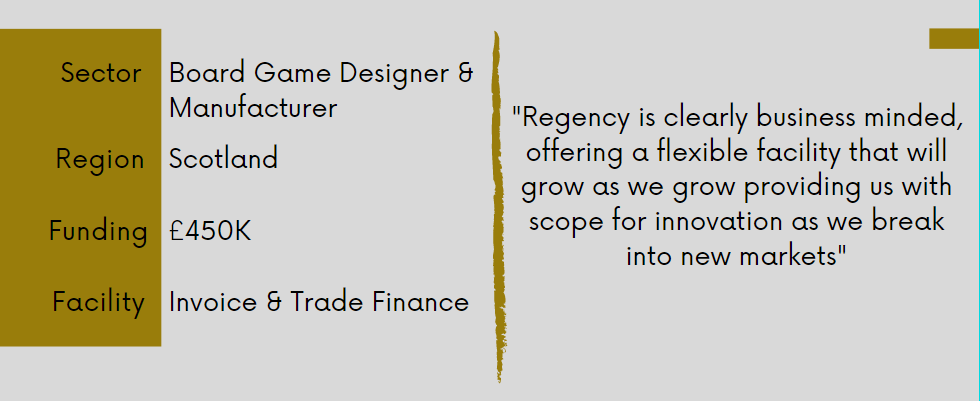

Incorporated as a private limited company in April 2004. Based in Edinburgh, the company designs and manufactures educational board games for their clients specific needs.

The 2 directors started the business following combined experience of over 20 years in business management and consulting. They saw an opening in the market to create games as an educational/training tool for both the corporate and public sectors.

With a head office in Edinburgh, they now employ 5 staff. They pride themselves their design and innovation, developing over 60 game based resources to improve training, education and engagement. Their games have been used by over 2 million people worldwide including doctors, nurses and care workers.

The Challenge

Previously with another invoice finance provider, our client had grown to such an extent, they needed a trade finance facility to allow them to purchase game components for the games following a substantial order from a large beverage supplier. Cashflow was becoming strained as they could not pay their suppliers.

The Solution

The combined invoice and trade finance facility has allowed the directors focus on its growth objectives with finance in place to recruit staff and increase sales. The strain on cashflow has eased through the use of the invoice finance facility with our expert credit control team.

Download a copy of this case study here.

To discuss the funding options available to your business. Please do not hesitate to contact us on 0161 280 4220 or lynnew@regencyfactors.com

what is invoice finance? invoice finance for recruitment, invoice finance for dummies, invoice finance for new business, invoice finance for startups, invoice finance with recourse, invoice finance meaning, invoice finance for small business, factoring example, invoice finance, invoice finance, invoice finance UK, how many businesses use invoice finance, why use invoice finance, why invoice finance, what is invoice finance, invoice finance and factoring, invoice finance and asset based lending, invoice finance agreement, invoice finance advantages, invoice finance arrangement, invoice finance alternative funding, invoice finance for new business, invoice finance blog, invoice finance bad credit, invoice finance benefits, invoice finance case study, invoice debtor finance, export invoice finance, easy invoice finance limited, invoice finance facts, invoice finance flowchart, invoice finance companies manchester