Incorporated as a private limited company in December 2009. Based in the North West, the company go to great lengths to source and develop their own fabrics and refine their clothing for sale.

The owner and Managing Director, acquired the business and it’s parent from it’s previous owners. He sold everything he owned, and borrowed as much as he could from the bank and friends to enable him to purchase the business.

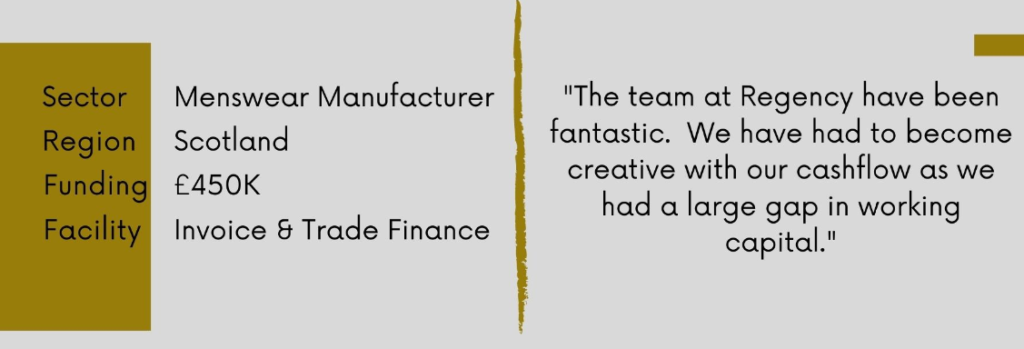

The subsidiary funded by Regency is a ready to wear menswear brand which has had particular success in the Asian markets. The clothing is primarilty exported to Japan and China where the market for ‘English’ products is huge.

The clothing is shown in Paris in January & June every year where buyers place their orders with a 3 month manufacturing window.

The Challenge

Our client was introduced to us as their incumbent invoice and trade financier were pulling out of the UK finance market and they needed another lender in place before their next show in Paris. They needed a lender who understands the nature of the industry and with experience in working with customers outside the UK.

The Solution

Regency works closely with the client to ensure they have the funding they need in place. With many customers in the Far East, we have additional measures in place to ensure verification of invoices.

There is also a trade finance facility in place to allow the purchase of fabric and raw materials, allowing the client to benefit from the early payment discount available.

To download the case study click here.

To discuss the funding options available to your business. Please do not hesitate to contact us on 0161 280 4220 or lynnew@regencyfactors.com

what is invoice finance? invoice finance for recruitment, invoice finance for dummies, invoice finance for new business, invoice finance for startups, invoice finance with recourse, invoice finance meaning, invoice finance for small business, factoring example, invoice finance, invoice finance, invoice finance UK, how many businesses use invoice finance, why use invoice finance, why invoice finance, what is invoice finance, invoice finance and factoring, invoice finance and asset based lending, invoice finance agreement, invoice finance advantages, invoice finance arrangement, invoice finance alternative funding, invoice finance for new business, invoice finance blog, invoice finance bad credit, invoice finance benefits, invoice finance case study, invoice debtor finance, export invoice finance, easy invoice finance limited, invoice finance facts, invoice finance flowchart, invoice finance companies manchester