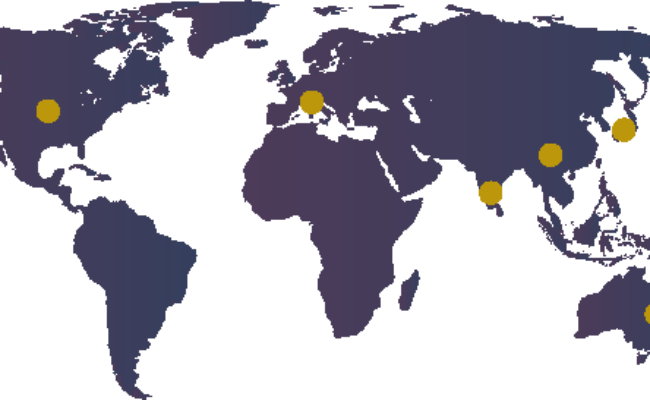

For many businesses, the lure of trading abroad is strong. After all, with so many different markets to trade in and opportunities seemingly endless, it’s…

1 in 3 businesses see late payment as one of their biggest threats to survival

When assessing your business and its health, one of the most vital areas to look at is that of cash flow. Good cash flow management is essential to the best practice of any small business, and is made up of two key elements.

Invoice Finance is an excellent alternative source of finance for businesses by significantly improving their cash flow. With debt factoring, a business can release immediate cash…

With the bounce back loans provided to UK businesses rapidly diminishing, it’s time to look at a longer term form of finance for UK SMEs.

Ever had a bag of naughty sweets at a charity event or football match? Our invoice finance client supplies them across the UK

Many small businesses suffer from immediate cash flow problems. While these issues can cause a company to collapse they don’t have to be the end of…

A business loan might help your SME Business in the short term, but an invoice finance facility can grow with your business and can be tailored to your needs